How Carriers are Leveraging AI for Fighting Fraud

A recent survey conducted by Evadata of 19 carriers revealed that 3/4 of them are already using Artificial Intelligence (AI) within their anti-fraud teams. These teams are applying it in fraud investigations and for other exploratory internal initiatives. While AI is still in its early days, Evadata expects the proportion of carriers using AI to grow in the coming years as AI is implemented among more carriers to fight fraud and improve internal efficiencies. Below are the overall findings and top use cases.

A Rise in Insurance Fraud and How AI Helps

Fraud is on the rise in the insurance industry, and the resources to fight it are limited. Due to the tight labor market following the pandemic, insurers faced a shortage of skilled fraud specialists, according to industry professional Justin Fowler at Clearspeed. Recruiting talent in this industry has become increasingly difficult, even as fraudulent activity becomes more widespread and complex. Detection is more critical than ever as opportunistic fraud expands with schemes such as inflating damages and fake claims.

The sophistication of today’s fraud demands a new solution. AI is proving to be a powerful tool to combat fraud due to its ability to summarize large quantities of data and recognize patterns to help insurers stay ahead. It is transforming the practice of fraud detection and prevention altogether.

Top Use Cases for Fighting Fraud with AI

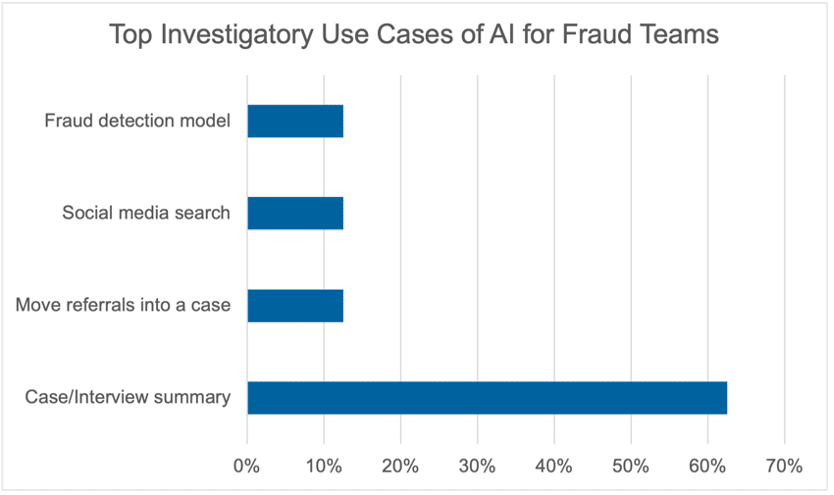

A survey conducted with 19 carriers revealed that 74% of them were already leveraging AI tools in their anti-fraud teams. These teams use AI for case and interview summaries in fraud investigations. Using AI, they were able to expedite the traditionally tedious, manual, and document-heavy process of sorting through data to compile only the necessary information. An initial case submission can be quickly summarized and copy/pasted into the case file. It can even create a timeline of all the events around the fraud event. In addition, the other top uses are moving referrals into formal cases, conducting social media and court records searches, and using it to power fraud detection models. By automating these time-intensive processes, insurers can focus more resources on strategic decisions and less resources on administrative tasks.

Exploratory Anti-Fraud Use Cases

Anti-fraud teams were also leveraging AI in experimental ways to prove them out before implementing them across the team. According to the survey, the top exploratory use was adding AI into the case management system functionality. This function would support summaries coming out of the system for reporting to states and prosecutors and analyzing trends across different cases. The second use was to summarize case work and interviews, to save the investigator time and allow them to focus on the decision. Third was to identify alterations in a PDF document or images, since fraudsters are known to be using “dark web” versions of AI tools to create false claim forms and death certificates. Finally, teams were exploring the use of AI to detect spoofed emails, as more fraud schemes involve fake emails to impersonate customers and agents.

Non-Investigatory Use Cases

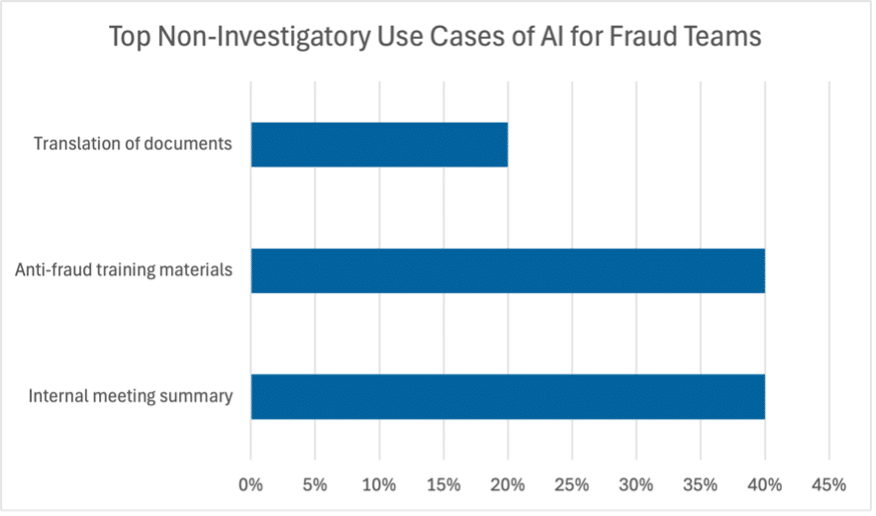

These teams were also turning to AI for non-investigatory purposes, instead leveraging it for unique internal purposes. Top use cases were to summarize meetings, build team training materials, and even to translate foreign documents. Foreign documents commonly come up in life insurance, when a death occurs in other countries. Ultimately, AI is certainly changing the way carriers detect fraud, but carriers are also experimenting with usage in other ways to increase efficiency for insurers and clients alike.

Specific AI Tools Used by Anti-Fraud Teams

The survey also revealed the varying adoption of specific AI technologies within anti-fraud departments. There was no single universal tool used across all organizations; however, ChatGPT Enterprise and Microsoft Copilot were the most popular choices. ChatGPT Enterprise, a subscription platform by OpenAI designed for businesses, leads the pack at 46%. It prioritizes enterprise-grade security, privacy, and performance features compared to ChatGPT. Microsoft Copilot was second at 35%. Other categories such as “External Tools” (12%) and “Internally Built Tools” (7%) are less common, possibly due to higher development costs and limited scalability. These different technologies showcase the strategic importance of selecting AI tools that align best with the company’s structure and specific fraud-prevention team needs.

Barriers of Implementing AI

While AI tools are readily available to use for investigations, deploying them for fraud detection models is more complex. According to insurance fraud expert Robert McGinley at PwC, AI models are only effective with good quality data. Low-quality, incomplete, or biased data input will lead to inaccurate results. As fraud patterns change, these models must be consistently updated to be effective. While there are countless use-cases for AI within the insurance industry, it does not come without cost. It requires new investments in infrastructure, and compliance with regulatory and ethical standards. For companies considering AI in their anti-fraud efforts, it is critical to ensure that AI tools are deployed securely.

Key Takeaways and Actions Steps

As Evadata interviewed surveyed carriers, it became clear that many organizations are still in the early stages of figuring out how to implement AI effectively. Carriers recognize the potential, but also voiced the need for clearer direction, better data infrastructure, and updated security. Here are a few steps that insurers can take to strategically integrate AI into fraud prevention efforts:

I. Understand the Importance of Secure AI Platforms

Free AI platforms like ChatGPT or Google Gemini are useful, but they’re not built to securely handle sensitive case data. Carriers should avoid uploading confidential materials into unsecured AI platforms and prioritize enterprise-grade AI solutions that offer strict data privacy features to protect confidential information.

II. Use AI as a tool, not a replacement

AI enhances fraud detection speed but does not replace human investigators. Rather than replacing their roles, AI should be seen as a tool that amplifies their capabilities and improves workflows.

III. Modernize data infrastructure and work with IT

AI effectiveness lies in accessible and structured data. Work with your IT team to audit current systems and invest in upgrades that support automation. Outline specific needs and use cases so your IT department understands where AI can be most useful.

IV. Develop an implementation plan

This should include:

- A rollout strategy to identify use cases

- Trainings and best practices to ensure staff are educated on how to safely leverage tools

- Integration timeline to map out key phases for adopting AI seamlessly

V. Start today

Fraud is evolving in the insurance space and AI provides a possible solution. Talk to your IT leaders and business stakeholders today to explore solutions for your anti-fraud initiatives.

Sources:

AI Tools for Investigations June 2025 – Evadata ACT Forum Thread and Round Table

“Fraud Detection and Prevention Using AI” April 2023 – Evadata ACT Webinar

“Life & Annuity Fraud: Leveraging AI, Finding Fraud Networks, and What to Anticipate for 2024” December 2023 – Evadata ACT Webinar

For Evadata source content, click here to request it.

ChatGPT Plus vs Enterprise: What are the Main Differences – https://undetectable.ai/blog/chatgpt-plus-vs-enterprise/

The impacts of AI & IoT in Insurance – https://www.equisoft.com/insights/insurance/the-impact-of-ai-iot-in-insurance